Jaký je rozdíl mezi virem a bakterií????????

Bakterie je jednobuněčný organismus, kdežto vir je jednoduchá živá soustava nebuněčná.

Vir není schopen konat jednotlivé životní funkce.Viry můžeme pozorovat pouze elektronovým mikroskopem.Způsobují VIROVÁ onemocnění rostlin, živočichů i člověka.

-spalničky

-zarděnky

-neštovice

-dětská obrna

-žloutenka

-AIDS - smrtelně nebezpečné onemocnění Přenos:

-pohlavním stykem

-kapénkou

-krví

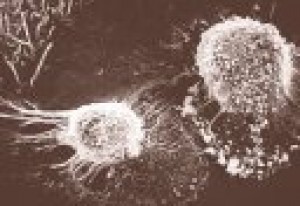

Některé viry mohou způsobit hromadění a nádorový růst buněk (způsobují rakovinu)

Bakterie

Nemají ohraničené nepravé jádro.Máji různé tvary:

-kulovitý (koky)

-tyčinkovitý (bacily)

-spirálovitý (spirochéty)

Jsou dva druhy bakterií : -choroboplodné a ty -co žijí v symbióze s člověkem.

Mohou způsobovat onemocnění:

-angína

-záněty dýchacího ústrojí

-tuberkulóza

-průjmová onemocnění

-tyfus

-cholera

-záškrt

-tetanus

Bakterie žijící s člověkem způsobují:

-mléčné kvašení

-rozkládají organický odpad

-půdní bakterie rozkládají odumřelé organismy .Tvoří humus!